You finally turned 16 years old, and what better way to celebrate your birthday than with a brand new car? But when you arrive at the dealership, the salesman informs you prices are about to raise—much higher than what your parents had approved. Tariffs are to blame, driving up costs, especially for vehicles and their parts.

Congress defines tariffs as “a tax levied on imported goods and services.”

Pierre Chevrolet and Elliot Bay Brokers, two dealerships within five miles of UPrep, are both expecting prices to increase with the influence of tariffs.

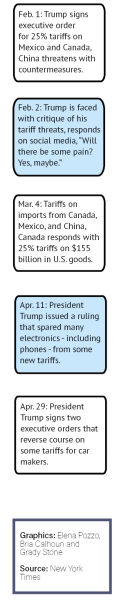

On April 2, 2025, President Trump announced new “reciprocal” tariffs: 34% on China, 20% on the EU, 25% on South Korea, 24% on Japan and 32% on Taiwan—on top of earlier tariffs, including a 20% tax on all Chinese imports, according to PBS.

On April 9, the Trump administration said it would suspend many of these tariffs for 90 days, excluding China. The administration announced that import taxes were raised to 125%, later clarifying the number was 145%.

“Tariffs are designed to protect domestic industries and promote the purchase of domestic goods,” upper school history and macroeconomics teacher Pat Grant said.

Grant adds that tariffs come with winners and losers.

“The winners are companies that are making goods entirely within the United States,” Grant said. “The losers are companies that depend on selling those goods to other countries.”

Junior Gavin Angeloff has doubts that students understand the full scope of tariffs.

“My understanding of tariffs is probably better than the average student,” Angeloff said. “When I’ve talked to my friends about tariffs in the past, they seem to understand some part of what tariffs do, but not the whole thing.”

As the investing club leader, Angeloff feels he understands the stress behind tariffs for investors.

“Investors worry about tariffs because they increase the operating costs of many businesses, making them less profitable,” Angeloff said.

Susan Lansverk, assistant head of school for finance and operations, notes that the school is affected by the ups and especially the downs that come with the stock market.

“Most economists say that tariffs will be inflationary. It’s an impact that happens,” Lansverk said. “The stock market is getting clobbered is not great for our investment portfolio. The school has had assets in those, just like [families] do and those are getting hit.”

Angeloff notes that the investing club on campus also holds stock from money given by the school board.

“We have a current fund of 100k that we have been working on investing throughout this year, and we will continue with that next year. We were given the money at t

he start of the year with the goal of investing it in stocks and trying to outperform UPrep’s own institutional investment fund,” Angeloff said. “We are trying to invest for the long term in our fund, so personally, I’m not that worried about our short-term unrealized losses.”

The changing market is not the only way that tariffs are influencing finances at the school.

Doug Moon, the associate director of admission and financial aid, notes that with the recent tariffs, applications for financial aid are expected to increase within the following year.

“I see more business owners applying, and applications increasing—especially for those who just are unsure,” Moon said. “A lot of folks who

maybe have not applied for financial aid in the past are applying this year.”

Moon emphasizes that the school understands the need to adapt policies.

“We work really closely together to make sure that we’re providing the best service for our families,” Moon said. “We’re just kind of monitoring and understanding what it may look like for the future. The great part about our policy is it’s always able to be tweaked and improved.”

At UPrep, rising costs tied to inflation could put added pressure on how the school allocates its financial resources.

“The majority of our budget is paying for salaries and benefits for faculty and staff,” Lansverk said. “Yes, there are going to be increases on certain things we buy, but it’s mostly the impact on salaries. If inflation gets out of control again then it’s difficult to manage that without having pressure on salaries.”